Blog

- Details

- Hits: 615

The festive season is here, and as such, many of us will be welcoming family and friends for parties with stays for the day and even overnight. From cousins to grannies, in-laws to old friends and new, you may find at times that you all feel on top of each other. Every year you probably tell yourself you are going to be more organised than previous years, so maybe this is the year that you actually win. As much as you can’t wait to have everyone under the same roof, there are bound to be times where things become a little stressful, and this is where a bit of planning can help to ease that guest stress this festive season.

- Details

- Hits: 780

Key information for how to Apply for Planning Permission:

- The average cost of a planning application is £2,000

- Architects and planning consultants can give you a better chance of success

- Any revisions you make will lead to more costs

Understanding planning permission is a crucial part of any building project. But getting to grips with all the required documentation and how much it’s going to cost can be a finicky process.

In this guide, we’ll explain everything you need to know to make a successful planning permission application and get your project off the ground.

- Details

- Hits: 583

Every buyer has a wishlist of what they want from their new home, and understanding buyers is important if you are looking to sell your home in the future. As the autumn nights draw in, your mind is no doubt focused on your interior rather than your exterior, but there is one feature that is dominating property listings, thus showing the demand from buyers. Post-pandemic is all about garden offices, and we can completely understand why.

Attracting buyers

The pandemic caused working patterns to change for many, and, even now, working from home, even just a couple of days a week, is more common than ever before. Therefore, optimising our home to create a separation between work and life is essential, which is why garden offices have grown in popularity. According to Rightmove, the proportion of property listings that mention a garden office is now 11 times higher than a decade ago: that’s a whopping 1046% increase.

This is not your average garden shed: these are spaces fully equipped with electricity and Wi-Fi, and many have fires, air conditioning and eco features. They are architecturally beautiful and sympathetically coexist with their gardens rather than competing against them for attention.

Rightmove's Tim Bannister said: 'Agents and developers have their finger on the pulse when it comes to the home features that will attract suitable buyers.

'Where dining rooms and fitted wardrobes may not be as important to some potential buyers compared with ten years ago, other features, like an outdoor office space, have soared as working patterns have changed, and the findings indicate a move towards greener features too.

'With outside space coming at such a premium, it may be that homeowners are ensuring what they build outside can be used in a number of different ways.

'For example, summer houses and orangeries are likely to have fewer or smaller windows than conservatories, and so can more suitably double up as home offices during the week and entertaining spaces at the weekend.'

Are they worth it?

It is no wonder that homeworkers are craving for a more practical and sustainable solution after years of working from spare bedrooms, kitchen tables and sofas. As the prospect of working from home remains, they seek a long-term rather than a temporary solution to aid a more productive and welcoming atmosphere.

Almost 1 million homeworkers have splashed out on a shed or garden office since COVID lockdowns started, according to research by Direct Line’s home insurance arm. Their survey also questioned estate agents on the benefits of a dedicated home office, which revealed that three quarters of them stated that they now add ‘considerably to the desirability and value of a property with properties for sale with a home office commanding a premium of £17,500’.

Is there a real need?

A recent TUC survey discovered that more than 38% of people in 2022 in the UK now work from home at least one day a week. In fact, ‘up to one fifth more people – or 241,000 individuals – are working in a garden office room or spare bedroom than they were 10 years ago.’ With figures like this it is no wonder that more buyers are attracted to a property that can provide them with a dedicated workspace as well as a relaxing home.

The benefits

Working from home can be isolating; you no longer have the chats whilst making a coffee in the office, those moments of physical interaction with colleagues. And even if you love the solitude, where you work has an enormous impact on your well-being, which is another reason why a garden office is so important.

Creating real separation between work and home life helps us to relax and also to focus: you are away from distractions and surrounded by nature and the seasons. Having a space in your garden truly brings the outside in, flooded with natural light which can give your mood a boost and also aid your productivity. No matter if it is a rainy day, just being in a green space has a whole other feeling; it is a calmer environment which can only help any stresses you may feel during your working day.

One of many

A garden office is just one of many features rising in popularity this year, according to Rightmove, such as bifold doors, underfloor heating and an open-plan layout. If you are considering making changes to your home and not sure what will add value and attract potential buyers, please come and have a chat to our sales team on.

We know exactly what is on buyers’ wish lists in your area.

- Details

- Hits: 618

Your new property has been found, the plan is in motion, and within a matter of weeks you will be moving home. It is a time that strains your emotions, and at some point you may feel frustrated and stressed. It is a huge upheaval for you and your family, and it can also take a big toll on the canine members of your family too! According to figures released this year by the PDSA, an estimated 10.2 million of us own a dog, with the Kennel Club stating that dog ownership soared by eight per cent in 2021. With this is mind, at Deakin-White we want to make the process of moving less stressful for every member of your household, and that includes your little dog too.

- Details

- Hits: 655

There is no doubt that we are in a time of uncertainty and there’s a lot of concern about what the future may bring. A September survey by Property Rescue, conducted by Perspectus Global, revealed that of 1,000 UK-based homeowners questioned 65% are worried and anxious about rising inflation and interest rates. Therefore, if you’re planning to sell your home this year, you want to ensure it sells quickly and doesn’t sit languishing on the market for months on end. With this in mind, our team at Deakin-White have put together some hot tips to increase the selling power of your home.

- Details

- Hits: 577

When selling your home, you have choices in how you achieve a sale; for many the most natural way is to instruct an estate agent to sell your home by traditional private treaty. But if you have been keeping an eagle eye on the property market, you may have come across an alternative: the modern method of auction. This is a simpler process than a normal auction; conducted online, it is more accessible to a wider range of buyers. With that is mind, is the modern method of auction the right way to sell YOUR home?

How does it work?

Selling your home through an estate agent is not always straightforward, and, with the backlog in the conveyancing process, according to Rightmove it takes 50 days longer than it did during the same period in 2019. This means it is currently taking around 150 days, on average, from the time a home is marked as ‘sale agreed’ until that very important completion day. The modern method of auction can be a quick and more convenient way to sell your home, but is it as rosy as it sounds?

When you sell your home through the modern method of auction, your property is marketed in similar ways to when you list the traditional way with an estate agent. You will find listings on the property portals such as Rightmove and also by estate agents like ourselves that offer this as part of our package of services. The auction runs over a period of around 30 days and buyers bid online from the comfort of their home, like they would for auction sites like eBay, and at the end of the auction the highest bidder wins.

If you were to purchase a property at a traditional auction you would have only 28 days to complete. But when you buy through the modern method you can opt to have 56 days to complete, allowing buyers time to organise a mortgage if necessary. This opens the doors to a wide range of buyers and thus increases the number of bidders.

What are the benefits?

One of the main benefits has to be the speed: when you compare the difference between the conveyancing process taking 150 days but a maximum of 56 with the modern method, you can see how choosing this type of auction can be extremely attractive if you are looking for a quick sale.

Another benefit is the greater level of certainty. When selling through traditional private treaty, once an offer has been accepted the sales process can sometimes be a rocky road and because no contracts have been signed either party can walk away. With the modern method, an auction is a binding agreement with a non-refundable deposit, making it a stronger to commitment.

Things to consider

One of the main things to consider is that you compromise on the sale price – you should expect to sell for approximately 85% to 90% of your home’s full value. On the plus side, the auction fees are covered by the buyer, so there will be no deductions from the sale price except for your legal fees.

Although there is more certainty than selling through traditional private treaty, it is not as certain as a traditional auction where, upon fall of the gavel, the sale exchanges making it legally binding. There is a legal agreement within the modern method between the buyer and auctioneer, it isn’t final, making it easier for buyers to back out.

Is it right for you?

As with all decisions about when and how to sell your property, it depends on your personal circumstances. As we start to enter the winter months, and the cost of living crisis starts to really take hold, you could be questioning which is better for you: to sell quickly or achieve the best price. If you are needing to free up cash quickly, the modern method of auction could be an option. Whereas ensuring you get the highest possible price of your property, and having the support of an estate agent through the entire sale, may be the solution.

Before you make any decisions, come and chat to our team at Deakin-White we can let you know how the property market is performing and answer all the questions you may have to help assess what is the right move and can help you with both options.

- Details

- Hits: 595

Who can believe we are already in November? These autumn days are filled with luscious colours: reds, oranges and yellows dominate our countryside, yet the season itself can really influence how we are feeling. This is because the lack of sunlight reduces our production of serotonin, which is the hormone that affects your mood, appetite and sleep. Design can have a positive affect on mental health; at Deakin-White we have put together some ideas on how your home can improve your well-being.

- Details

- Hits: 609

There has been a notable change in temperature over the last week or so; dare we say we even contemplated putting the heating on? It is the time of year where the nights are getting longer and the days colder, and when it comes to selling your property you want buyers to see the warmth your home exudes. In Norway, freezing winters are welcomed. Koselig is not directly translatable into English, but is often simplified as a ‘feeling of cosiness’; it’s a sense of intimacy, happiness and being content. What buyer wouldn’t start to see a Koselig house as a home? Could it be the key to selling this autumn?

- Details

- Hits: 580

The time to progress from the sale of a property to completion is now 17 weeks, which is the lowest in the last 12 months.

The average time taken for a homemover to move into a new property from putting it up for sale is now 20 weeks.

Pre-pandemic the duration was 18 weeks, and we are once again getting close to this milestone.

Good news is a rarity at present, however, for homemovers, we have some welcome news for you.

In summary, the time taken to sell a home has fallen dramatically in July 2022. We will explore this in more detail after we take you through a couple of definitions to ensure that we are all on the same page.

Definitions

- We refer to the following terms with the following meanings:

- Time to sell – will mean the time from advertising a property for sale to getting a sale agreed on the property.

- Time to progress – will mean the time it takes to progress the property from getting a sale agreed to moving in.

- Time to Progress

The great news is that the time to progress the sale of a property fell by 13% in July 2022, when compared to June 2022. In addition, from the data that we can see at present, it looks like August 2022 will maintain this fall.

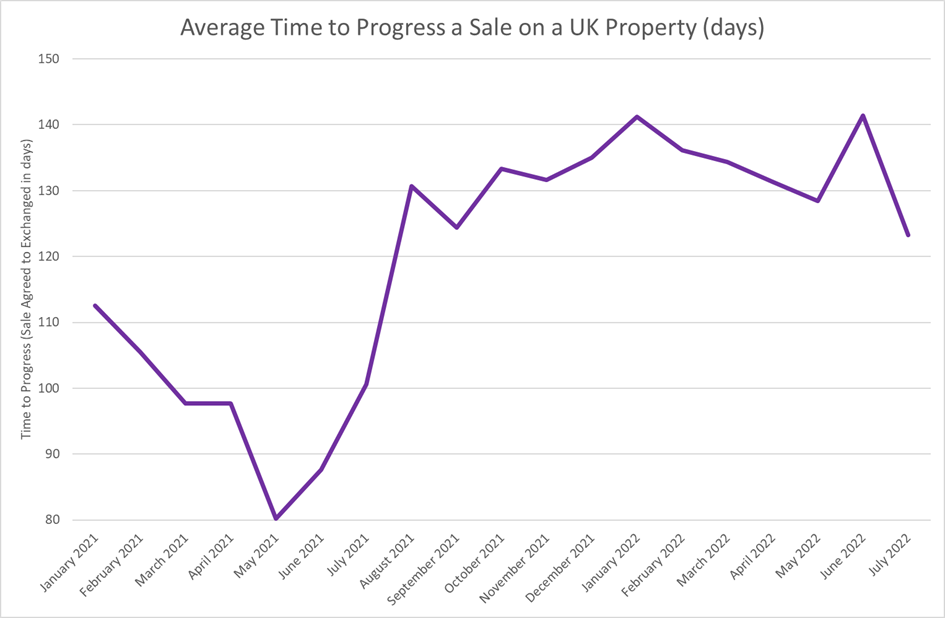

A chart containing the average (mean) time to progress for the last twelve months is below:

The time to progress in July was 123 days (or 17.6 weeks or 4 months) and as you can see from the chart above, this is the lowest time since July 2021.

Note that pre-pandemic (July 2019), the time to progress was 91 days (13 weeks or 3 months).

Time to Sell

Further good news is the time to sell the average property in July 2022 was a median of 19 days, which was unchanged from June 2022. I know everyone forgets their early maths days and that some of you wish that we could leave them behind forever, so to re-word this, this means that 50% of all properties that came to the market (that then have a sale agreed) had a sale agreed within 19 days.

So overall, this now makes the total time to sell and move into a property 142 days (which is of course 20 weeks or 4.7 months).

Pre-pandemic (July 2019), the time to sell was much larger at a median of 37 days. This makes the total time to move in July 2019 of 128 days (18 weeks or 4.2 months).

So, although we are not quite at pre-pandemic levels just yet, 20 weeks total time to move into a new average UK property is welcome news.

Editorial and credit goes to: FIA and Twenty CI